Recording Sales of Goods on Credit

When a company sells goods on credit, it reports the transaction on both its income statement and its balance sheet. On the income statement, increases are reported in sales revenues, cost of goods sold, and (possibly) expenses. On the balance sheet, an increase is reported in accounts receivable, a decrease is reported in inventory, and a change is reported in stockholders' equity for the amount of the net income earned on the sale.

If the sale is made with the terms FOB Shipping Point, the ownership of the goods is transferred at the seller's dock. If the sale is made with the terms FOB Destination, the ownership of the goods is transferred at the buyer's dock.

In principle, the seller should record the sales transaction when the ownership of the goods is transferred to the buyer. Practically speaking, however, accountants typically record the transaction at the time the sales invoice is prepared and the goods are shipped.

FOB Shipping Point

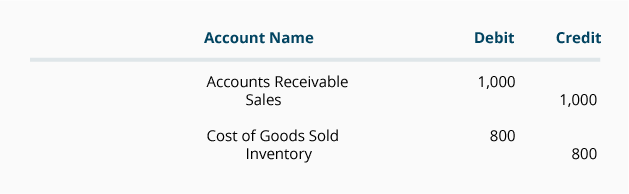

Quality Products Co. just sold and shipped $1,000 worth of goods using the terms FOB Shipping Point. With its cost of goods at 80% of sales value, Quality makes the following entries in its general ledger:

(While there may be additional expenses with this transaction—such as commission expense—we are not considering them in our example.)

FOB Shipping Point means the ownership of the goods is transferred to the buyer at the seller's dock. This means that the buyer is responsible for transporting the goods from Quality Product's shipping dock. Therefore, all shipping costs (as well as any damage that might be incurred during transit) are the responsibility of the buyer.

FOB Destination

FOB Destination means the ownership of the goods is transferred at the buyer's dock. This means the seller is responsible for transporting the goods to the customer's dock, and will factor in the cost of shipping when it sets its price for the goods.

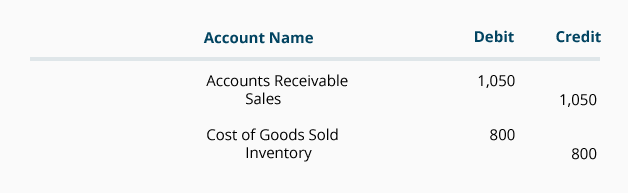

Let's assume that Gem Merchandise Co. makes a sale to a customer that has a sales value of $1,050 and a cost of goods sold at $800. This transaction affects the following accounts in Gem's general ledger:

Because Gem chooses to ship its goods FOB Destination, the ownership of the goods transfers at the buyer's dock. Therefore, Gem Merchandise assumes all the risks and costs associated with transporting the goods.

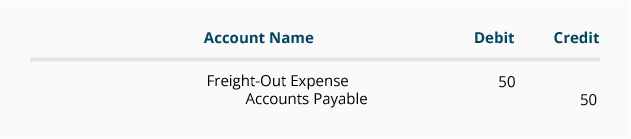

Now let's assume that Gem pays an independent shipping company $50 to transport the goods from its warehouse to the buyer's dock. Gem records the $50 as an operating expense or selling expense (in an account such as Delivery Expense, Freight-Out Expense, or Transportation-Out Expense). If the shipping company allows Gem to pay in 7 days, Gem will make the following entry in its general ledger:

Credit Terms with Discounts

When a seller offers credit terms of net 30 days, the net amount for the sales transaction is due 30 days after the sales invoice date.

To illustrate the meaning of net, assume that Gem Merchandise Co. sells $1,000 of goods to a customer. Upon receiving the goods the customer finds that $100 of the goods are not acceptable. The customer contacts Gem and is instructed to return the unacceptable goods. This means that Gem's net sale ends up being $900; the customer's net purchase will also be $900 ($1,000 minus the $100 returned). It also means that Gem's net receivable from this customer will be $900.

Unfortunately, companies who sell on credit often find that they don't receive payments from customers on time. In fact, one study found that if the credit term is net 30 days, the money, on average, arrived 45 days after the invoice date. In order to speed up these payments, some companies give credit terms that offer a discount to those customers who pay within a shorter period of time. The discount is referred to as a sales discount, cash discount, or an early payment discount, and the shorter period of time is known as the discount period. For example, the term 2/10, net 30 allows a customer to deduct 2% of the net amount owed if the customer pays within 10 days of the invoice date. If a customer does not pay within the discount period of 10 days, the net purchase amount (without the discount) is due 30 days after the invoice date.

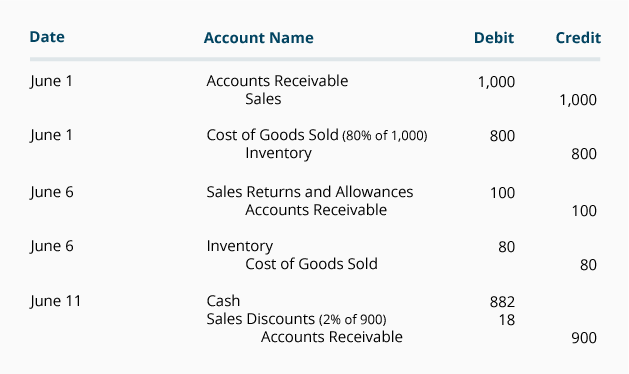

Using the example from above, let's illustrate how the credit term of 2/10, net 30 works. Gem Merchandise Co. ships $1,000 of goods and the customer returns $100 of unacceptable goods to Gem within a few days. At that point, the net amount owed by the customer is $900. If the customer pays Gem within 10 days of the invoice date, the customer is allowed to deduct $18 (2% of $900) from the net purchase of $900. In other words, the $900 amount can be settled for $882 if it is paid within the 10-day discount period.

Let's assume that the sale above took place on the first day that Gem was open for business, June 1. On June 6 Gem receives the returned goods and restocks them, and on June 11 it receives $882 from the buyer. Gem's cost of goods is 80% of their original selling prices (before discounts). The above transactions are reflected in Gem's general ledger as follows:

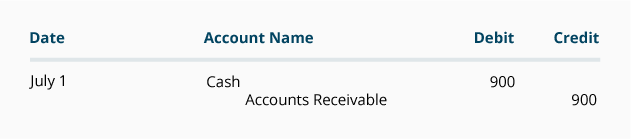

If the customer waits 30 days to pay Gem, the June 11 entry shown above will not occur. In its place will be the following entry on July 1:

Examples of Amounts Due Under Varying Credit Terms

The following chart shows the amounts a seller would receive under various credit terms for a merchandise sale of $1,000 and an authorized return of $100 of goods.

| Credit Terms | Brief Description | Amount To Be Received |

| Net 10 days | The net amount is due within 10 days of the invoice date. | $900 |

| Net 30 days | The net amount is due within 30 days of the invoice date. | $900 |

| Net 60 days | The net amount is due within 60 days of the invoice date. | $900 |

| 2/10, n/30 | If paid within 10 days of the invoice date, the buyer may deduct 2% from the net amount. ($900 minus $18) | $882 |

| 2/10, n/30 | If paid in 30 days of the invoice date, the net amount is due. | $900 |

| 1/10, n/60 | If paid within 10 days of the invoice date, the buyer may deduct 1% from the net amount. ($900 minus $9) | $891 |

| 1/10, n/60 | If paid in 60 days of the invoice date, the net amount is due. | $900 |

| Net EOM 10 | The net amount is due within 10 days after the end of the month (EOM). In other words, payment for any sale made in June is due by July 10. | $900 |

Costs of Discounts

Some people believe that the credit term of 2/10, net 30 is far too generous. They argue that when a $900 receivable is settled for $882 (simply because the customer pays 20 days early) the seller is, in effect, giving the buyer the equivalent of a 36% annual interest rate (2% for 20 days equates to 36% for 360 days). Some sellers won't offer terms such as 2/10, net 30 because of these high percentage equivalents. Other sellers are discouraged to find that some customers take the discount and ignore the obligation to pay within the stated discount period.

» Tin mới nhất:

- Cách GHI – ĐỌC dữ liệu từ tệp tin trong ngôn ngữ Java (18/12/2024)

- Những Website Check Lỗi Ngữ Pháp Tiếng Anh Chất Lượng (18/05/2024)

- The writing process and assessment (18/05/2024)

- Những kinh nghiệm làm đồ án dành cho sinh viên kiến trúc (18/05/2024)

- Vai trò của các công cụ khuyến mãi đối với hành vi tiêu dùng (18/05/2024)

» Các tin khác:

- Difference between Expense and Allowance (17/03/2017)

- What is Lean and Why Should CFOs and Accountants Care? (17/03/2017)

- 7 điều đánh thức khả năng tiềm ẩn, khơi dậy "thiên tài" trong con người bạn (17/03/2017)

- Chiến lược tài chính (17/03/2017)

- TRUYỀN THÔNG TÀI CHÍNH (17/03/2017)

- PHƯƠNG PHÁP LUYỆN THI LISTENING TRONG IELTS (17/03/2017)

- 20 câu nói nổi tiếng của Bill Gates (17/03/2017)

- Kỹ năng mua hàng chuyên nghiệp (16/03/2017)

- Làm thế nào để thuyết phục ứng viên gia nhập start up của bạn? (16/03/2017)

- Làm thế nào để thuyết phục ứng viên gia nhập start up của bạn? (16/03/2017)